The Last Crusade

Fighting for the Holy Land of Industrialism

What caused the Industrial Revolution? That question’s almost always in the back of my mind. And if you weren’t paying attention, there’s an exciting new paper out in the Journal of Political Economy that, for perhaps the first time, takes a dedicated modern econ approach to answering it. Written by Morgan Kelly, Joel Mokyr, and Cormac O’Grada, “The Mechanics of the Industrial Revolution” tries to put some econometric meat on the bones of a theory that the three of them first set out nearly a decade ago: that artisanal skill explains why Britain invented and adopted mechanized technology during the late eighteenth century. Simply put, Britain had a larger pre-existing stock of workers with enough mechanical proficiency to implement the designs of inventors and maintain and refine the machines. France, which had plenty of inventors but fewer engineers, was forced to import them from Britain.

This theory is deliberately set against Bob Allen’s influential induced innovation story of the Industrial Revolution, which posits that high wages relative to the prices of capital and coal in Britain incentivized the invention and adoption of technologies that were more intensive in the latter. Other nations could not follow suit until the British had devised and exported machines that were compatible with their factor prices. The “high wage explanation” has taken some empirical criticism over the past decade as historians like Judy Stephenson, Jane Humphries, and Jacob Weisdorf produced evidence suggesting that the wage estimates upon which Allen had based his work were mistaken. Now, however, we’ve got a true alternative theory to work with. How good is it?

I like to start at the beginning. Joel Mokyr has never liked high-wage explanations of invention;1 in The Lever of Riches (1990), he inveighs against the Habbakuk thesis, arguing that inventors tried to save on both labor and capital, only inadvertently saving more on the latter, citing a statistic from MacLeod (1988) that only 3.7 percent of British patentors had stated labor-saving as their intention. He repeats these remarks in The Enlightened Economy (2009), with the proviso that factor prices may determine the direction, not the rate, of technological change. I was listening to Mokyr interviewed on the VoxTalks podcast the other day, where he in no uncertain terms called the HWE “bogus” and “basically wrong.” Don’t hold back!

This isn’t an intellectual biography of Mokyr, though, so we’ll fast forward to 2014. Five years after Allen’s provocative The British Industrial Revolution in Global Perspective, which lays out his grand theory, Kelly, Mokyr, and O’Grada published their own in “Precocious Albion: A New Reinterpretation.” Taking a comparative approach, they concede that British wages were higher than French, but argue that this was merely compensation for higher labor force quality. Thus British unit labor costs—how much an employer paid to produce one piece of output—were paradoxically lower than French. There were two dimensions to this: “physical-cognitive” and human capital. British workers were fed better than the French, eating more meat and getting more calories in general; this made them stronger, more energetic, and smarter. Superior nutrition was the result of more productive agriculture, integrated internal transport systems, Irish imports, and the Poor Laws.2 Secondly, the British apprenticeship system worked well at transmitting tacit knowledge from masters to learners, despite the country’s embarrassingly bad education provision. This is undoubtedly a second-order effect, because one has to wonder why the lack of guild oversight and efficient conflict resolution should have obtained. Good institutions are endogenous! It’s also tough to quantify: the authors rely heavily on anecdotes about British workers setting up shop on the continent. But it’s indisputable that British workers A) ate more B) were more productive and C) were paid more than their French counterparts. This is one interpretation.

In the new paper, Kelly et al. double down on skills. The basic idea is this: no matter how good you are at inventing things, prototypes don’t get turned into productivity unless you can make machines that work. Ideally, you’d have a cadre of industry experts to make the factories run—but what if the industry doesn’t exist yet? You have to use the next best thing: people with adjacent, flexible skills that can readily be adapted. Fortunately, Britain had a lot of these people—watchmakers, millwrights, and coal miners—dubbed “engineers” or “mechanics” by the authors. These men put together the elaborate gearing systems of Richard Arkwright’s famous water frame, which were in many ways custom-made devices that required craft skill to erect. Watchmakers had the finesse to work with the soft brass gears of early textile machinery, which the authors note was still known as “clockwork” long after durable iron parts had allowed iron founders and specialized machine firms to batch-produce them. A millwright, in the words of William Fairburn, was a man who could “turn, bore and forge ... was a fair arithmetician who knew something of geometry and [could] do much of the work now done by civil engineers” (quoted in Mokyr 2021), and the inventors of gas lighting and threshing and paper-making machines came from that stock.

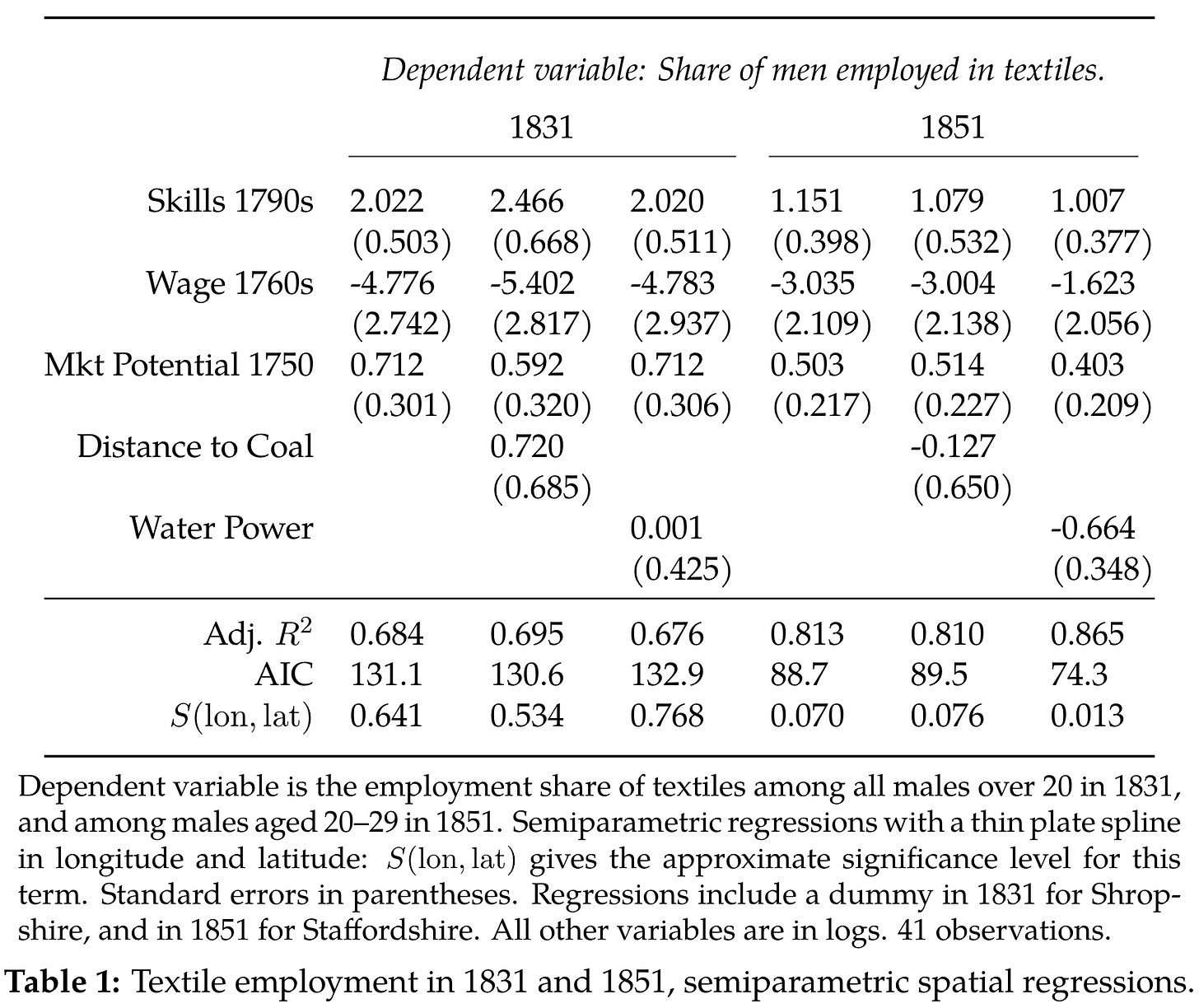

So far, so good, but it’s still just anecdote. To prove this, the authors try to show that the pattern of textile and metallurgical concentration across Britain was determined by pre-existing clusters of skilled labor. The problem here is, unsurprisingly, that adequate statistics neither for “skilled people” nor “innovative industry” really exist for the eighteenth century on a sufficiently disaggregated scale. The first census was taken in 1801, and the authors have data for textile employment at the county-level starting in 1831. They also have wages in 1760. To measure “skills,” they have to adapt: they count “blacksmiths, millwrights (both traditional skills), watch- and instrument makers, gunsmiths and locksmiths, toolmakers, sheet-metal workers, and mechanics” above the age of 60 in the 1851 census. These men would presumably have been apprenticed at age 14 in the 1790s, and their sum proxies for the availability of skill in that decade. This is the key explanatory variable: the authors regress 1831/51 textile employment on “1790 skills,” controlling for water flow (proxying for water mill suitability), coal proximity, and market potential.3

Why would skilled employment differ across counties? Kelly et al. set up a pretty straightforward trade model to illustrate. There are two regions, North and South, one (North) with less fertile land. Falling transport costs makes food cheaper in North, reducing the demand for unskilled labor in agriculture and pushing it into manufacturing. This raises the wages of skilled labor (artisans, engineers)—for which unskilled labor is a complement—and attracts more such people to the region. Skilled workers and manufacturing output thus concentrate in regions with poor soil and low wages; but the resulting agglomeration economies (learning-by-doing, sharing of workers) in the low-wage regions leads ultimately to a “reversal of fortune” after the industrial revolution. The empirical prediction, then, is that the counties with low wages and high skills should be more industrialized in 1831, and high-wage, low-skill regions comparatively backward and underdeveloped. It’s a core-periphery model within Britain!

And that’s exactly what the authors observe. Take a look at Table 1. The skills variable is highly significant, and though wages are less so, the coefficient is pretty large. Together with market potential, the two variables explain ~70% of regional variation in textile emploment in 1831 and over 80 percent in 1851. That’s a lot! You’ve probably already seen Figure 4, too. It’s very convincing. There’s clearly a pretty strong correlation between wages, textile employment, and skills. Regions with lots of textile workers in the mid-nineteenth centuries certainly did have low wages in the 1760s and lots of artisans/engineers in the 1790s. And for what it’s worth, I totally believe this story, or at least part of it. Pools of engineers greased the wheels of growth, and internal market integration helped to get those wheels rolling.

“But hold on,” you should be thinking (or at least I was). “Those ‘skills’ variables—even if we believe them—are from the 1790s.” British growth may have been halting prior to that year, but it was well underway. So was market integration. And you’d expect skilled labor to migrate to areas of industrial growth, where demand for machine-fixers is high. And things that cause economic growth also tend to be pretty favorable to skill development. Last year, for instance,Maxine Berg and Pat Hudson strongly rebutted Mokyr’s qualitative presentation of the “mechanics” theory. Mokyr had previously asserted that “British mechanical ingenuity was behind the supply response to rising demand, but the primary causality was from human capital and low prices to exports”; human capital, in turn, was—as we discussed above—generated by the apprenticeship system, reasonably low inequality, and good institutions. Against this internalist view, Berg and Hudson rejoin that skills are important, but the real prime mover was foreign commerce, by which they mostly mean slaving and cotton. Britain’s preeminence in the Atlantic trade drove structural transformation near seaports like Liverpool and Bristol and supplied raw materials and investment capital to nascent industry, all of which created demand for artisans. Trade drove economic growth, and trade also drove the accumulation of skills; thus the latter could easily be endogenous to the former or confounded by some second variable (trade, institutions, etc).

Whether or not you believe the Berg-Hudson story, it’s difficult to interpret the 1790s skill measure as representing the pre-existing clustering of mechanics, and thus to treat Table 1 as a causal estimate. Kelly and co. know this:4 they instrument for skills using the cost of becoming a watchmaker from 1750 to 1779. The instrument is definitely relevant—since (as they argue) this figure is similar across trades, places with lower entry fees should have more skills. But is it really exogenous? I have concerns. Good instruments are things that are determined independently of the process of interest and that influence it only through the main right-hand-side variable. Reka Juhasz, for example, has a recent paper where she instruments for the probability of getting a telegraph connection to London with undersea ruggedness on the route. Non-economic variables—geography, policy rules, etc.—with an element of arbitrariness work best. But as the authors themselves admit, “counties that had a larger supply of masters making things like locks, guns, and instruments would charge lower fees in the market for apprenticeship.” So that doesn’t really solve the problem, to my mind. Surely the number of masters is also potentially endogenous to textile development or confounded by trade/institutions in the same way as the skill measure? We’re just using a different measure of the same thing. Another curious point: the IV estimates are about 50% larger than the OLS estimates, which is odd, if we’re supposed to be reducing endogeneity bias, which should overstate the effects of skills. I’m assuming that this is a local average treatment effect thing—regions that got more skilled labor benefitted more from it—but I’m not sure. I’m perfectly happy to be told that I have either of these issues wrong, though.

Another worry I have, as Pseudoerasmus pointed out, is that this paper has kind of lost the comparative perspective that’s at the heart of “Precocious Albion.” The 2014 paper was all about comparing England and France on nutrition, wages, productivity, and human capital formation. If your question is “Why Britain?”—and the paper opens with the sentence “The question of British leadership in the Industrial Revolution remains one of the central topics in economic history”—then it’s reasonable to expect that you make comparisons with Britain’s rivals. But this paper compares regions within Britain. So even if skilled artisans did help to determine the locus of production, we still don’t know if this factor differentiated Britain. Likewise, I think dismissing the role of coal on this basis of probably unfair, although the differential importance for textiles (zero) and metallurgy (substantial) is relatively convincing evidence that it shouldn’t have mattered much given the greater importance of water power until well into the nineteenth century. If coal prices were contained within a relatively narrow band within Britain, then low labor costs and high skill concentration could determine the location of production within the country while the relative prices of coal and labor determined the international distribution. I don’t think that you should argue this, though.

Other Thoughts

One thing that I’m conflicted about is the message of this paper. Joel Mokyr is one of my academic idols, and what I admired so much about his early work was his willingness to engage with intellectual factors—i.e. science—as explanations for Anglo-European take-off. “The Mechanics of the Industrial Revolution” takes a grittier view, looking at the unglamorous workmen who kept the machines running rather than the scholars who (allegedly) devised them, and roots the British development process in an economic model that’s actually kind of redolent of Allen’s. You don’t need science to explain anything that’s going on here—indeed, the word “science” shows up only three times in the paper, and always in footnotes! It’s immaterial whether It’s still internally consistent with the rest of Mokyr’s work: he has always asserted that Britain was little better than the Continent at invention, whose Enlightenment was a pan-European phenomenon. But this is still a shift in emphasis, to my mind, and though I find this a stronger argument than the “Industrial Enlightenment” view presented in The Enlightened Economy and The Culture of Growth, I still feel slightly betrayed. Que sera sera.

It’s interesting that debunking the high-wage explanation should remain, even in 2022, a major motivation for this paper. Clearly it remains popular among amateurs like me, but I was under the impression that the Stephenson-Humphries-Weisdorf axis had mostly laid it to rest. Even in “Precocious Albion,” Kelly et al. raise some fairly damning objections: high wages don’t imply high unit labor costs, steam power largely substituted for water power, few patentors actively sought to save labor, the jenny was immediately profitable in France, etc. I’ll try to do a post on this in the future. While I don’t think you can refute the HWE with this research design—it requires international wage, energy price, and productivity comparisons—some version of the “millwrights and mechanics”5 view has replaced it as my go-to economic explanation for why the Industrial Revolution was British. The process of domestic market integration that the authors deem central to producing regional specialization was key (I’ve written about this before, as has Anton Howes) and unique to Britain. This would have differentiated agglomerations of manufacturing expertise both within Britain and by comparison with the continent, where higher internal transport costs spread out textile production across regions (the central prediction of the Krugman core-periphery model). And while I’m hesitant about a model where one form of labor is completely mobile and another isn’t, regions with existing concentrations of skill should have been better-placed to exploit this process. As historians, we should bow to the endogeneity anyway—important causal interactions like this are usually two-way streets, and it’s hard to parcel out a “true” effect.

To conclude, I think that this paper, while not quite getting at the biggest “why” question about the Industrial Revolution’s origins, offers a pretty compelling explanation of how the process actuall happened. It’ll take further work to piece together the causal story, especially making international skill comparisons akin to the wage work that the Allen agenda inspired; but that’s one of the exciting consequences of an interesting and groundbreaking bit of research.

Which aren’t new. The “Habbakuk thesis” that free land raised US factory wages and spurred mechanization in the nineteenth century is a venerable one.

Oh, and high wages.

“The sum of aggregate income (1760s wage times 1750 population) of each county weighted by the inverse squared distance to the centre of the county” (Kelly et al. 2022, p. 32). Also apparently innovative is their method of controlling for spatial dependence, a bugbear of Kelly’s, with a two-dimensional spline in latitude and longitude that removes low-frequency trends and makes standard inference with spatial adjustments viable. See appendix for details.

“The natural concern with these OLS results showing how skill supply is strongly correlated with textile employment is that the supply of skills was endogenous: new industries, even as early as the 1790s, may have encouraged inward migration of skilled workers, or caused men in traditional industries, like millwrights and blacksmiths, to become specialized machine builders.”

M&M?

Two relevant books that lie quasi-outside the academic papers: Priya Satia, The Empire of Guns https://www.amazon.co.uk/Empire-Guns-Priya-Satia/dp/0715653040 and Barbara Hahn, Technology in the Industrial Revolution https://www.cambridge.org/core/books/technology-in-the-industrial-revolution/949B7F585E30055E0CF08828C2F50C0B