Week of May 16, 2021

The Where, Why, and What of Industrial Revolutions

We’re back, and returning without an ounce of shame to my favorite topic—the Industrial Revolution, the pivotal point in the persistent mystery of economic growth. While the first paper looks at how policy shaped this process in twentieth-century Korea, the remainder are classic works on the original iteration in England. As Robert Lucas once wrote, “[t]he consequences for human welfare involved in questions like these are simply staggering: Once one starts to think about them, it is hard to think about anything else.” I try not to.

Enjoy!

Manufacturing Revolutions - Industrial Policy and Industrialization in South Korea

Nathan Lane | Working Paper | 2019

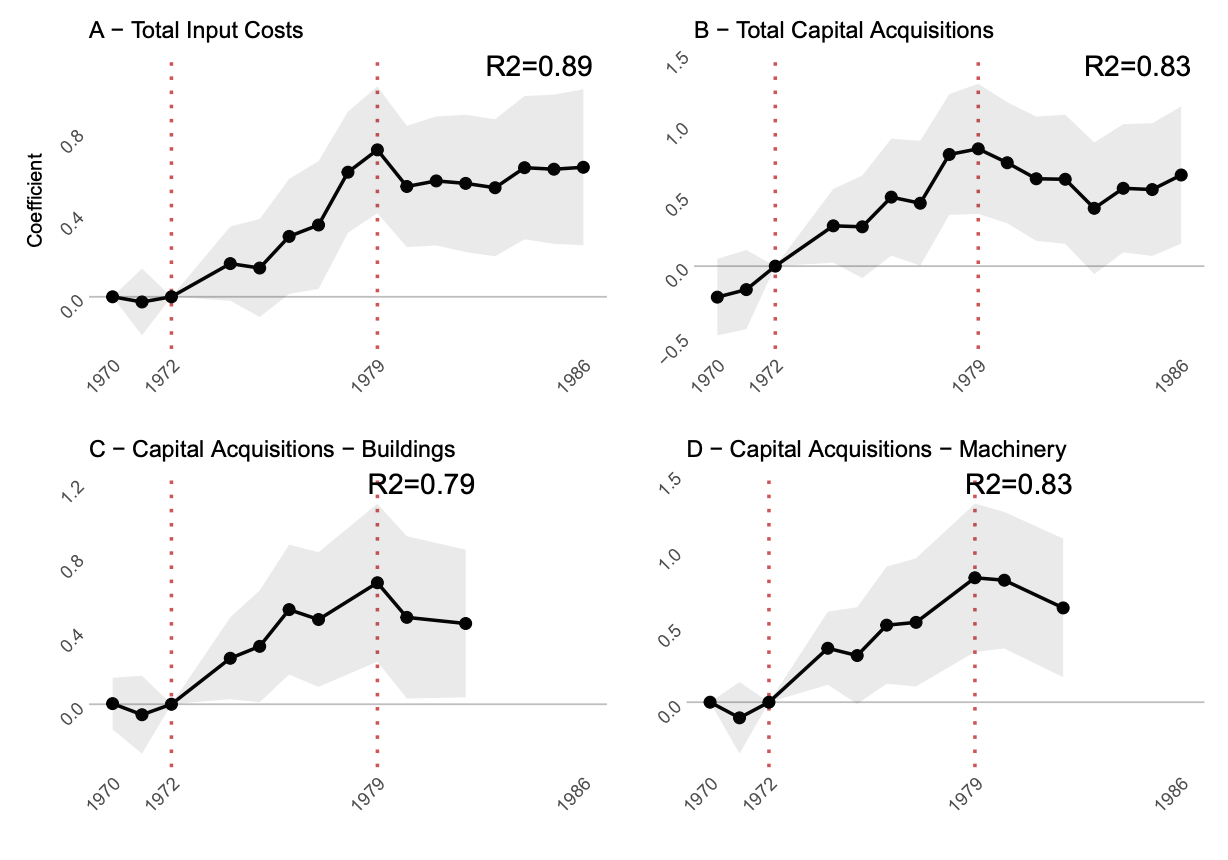

This paper studies the industrialization drive in South Korea, one of Rodrik’s cases in his theoretical survey that we discussed last week. The so-called Heavy Industry and Chemicals (HCI) program was launched by President Park Chung-hee in 1973 as a response to Nixon’s announcement of America’s impending military withdrawal from East Asia, and was curtailed by his assassination in 1979.1 The drive targeted six classes of strategic industry—steel, non-ferrous metals, machinery, shipbuilding, electronics, and petrochemicals—with credit incentives and import tariff exemptions, a dramatic switch from the preceding policy of non-discriminating export promotion. The period thus serves as a relatively well-defined natural experiment for an event study-type methodology. Comparing targeted with non-strategic industries, Lane finds that the former saw 99 percent relative increases and capital goods purchases and 61 percent higher relative input buying as a result of government subsidies. Output increased by 80 percent and prices dropped by 11 percent, and these differential gaps persisted after the end of the program in 1979. While downstream industries benefitted from greater and cheaper availability of supply, “backward-linkages” were actually neglected by the prioritization of foreign inputs. Moreover, though manufacturing employment and productivity both rose, real wages did not actually increase. Many will disagree, but I remain skeptical about treating these results as a strong endorsement of industrial policy, or at least industrial policy qua welfare-enhancing program. The sectoral balance of output was successfully altered, but unless one treats the possession of heavy industry at all costs as an unalloyed good, this seems to be an equivocal outcome.2

Robert C. Allen | Explorations in Economic History | 2009

Most accounts of the British Industrial Revolution point to the last two to four decades of the eighteenth century as the point of take-off for sustained growth. Why, then, did real wages stagnate (while profits rose) between 1800 and 1840—just as steam engines, water frames, and puddling and rolling were diffusing through the English economy? The classical economists had an answer: economic growth was impossible. For Marx, advancing technology meant the immiseration of the working classes through the substitution of capital for labor. For Malthus and Ricardo, population growth (which sped up rapidly during the early nineteenth century) would inevitably siphon off any real wage gains and channel profits to the owners of property. Allen sets out his own answer to the question of why “Engels’ Pause” interrupted the “inverted hockey curve” of modern economic growth. Using a growth model based on a translog production function, he simulates movements in real wages, profits, and investment during the nineteenth century to produce a surprising result: inequality was a necessary consequence of productivity growth. With a low elasticity of substitution between capital and labor, rising population and its effective increase through labor-augmenting technical change boosted the demand for capital. The rate of return spiked and real wages flatlined, shifting capital’s share of national product. But this movement was “self-extinguishing”: higher incomes for the wealthy meant more investment in capital, restoring the capital-labor ratio and promoting the diffusion of inventions that increased substitutability between factors. By 1860, real wages and TFP had begun to grow in lock-step, and within two decades, the former had accelerated to 1.61 percent while TFP remained at 1.03 percent per annum. This is a truly great paper, which does the truly enviable job of explaining a lot with surprisingly little.3

Industrial Revolution in England and France: Some Thoughts on the Question, “Why was England First?

Nicholas Crafts | Economic History Review | 1977

Long term readers of this newsletter will find some strangely familiar themes in this slightly dated article by Nicholas Crafts, who—in the context of explaining the differential timing of the Industrial Revolution on each side of the English channel—explores several of the deep meta-historical questions that led me to economic history in the first place. Reacting to the “classic” school of explanation, which sought internal forces that made take-off more likely in Britain (or less so in France), Crafts argues that the crucial inventions were the “evolutionary outcome of a stochastic process”; luck could have handed the less-creative nation a technological lead upon which to found a persistent advantage. He argues that no evidence (neither science nor patenting activity) suggests a higher level of inventiveness in England and that historians had assumed most of her “distinctive” qualities backward from the extent of her eventual success. This tendency, he contends, was an understandable overreaction to the old “cataclysmic” histories of the late nineteenth and early twentieth centuries—if the Industrial Revolution had a cause, then surely some elements of English society were “favorable” to technical and economic change. Studying the event comparatively yields three principal conclusions: that take-off in England was not inevitable; that the question, “Why England?” asked about a unique occurrence yields no historical insights; and that “re-running” the eighteenth century might well produce a distribution of different outcomes. The second point is the most interesting of the three. Crafts contends that the Industrial Revolution, as a singular datum, cannot serve any “covering law” seeking to establish regularities in history. The proper mode of inquiry, he believes(d?) is seeking to understand whether any factors existed that weighted the relative probabilities in England’s favor in this specific instance. I am not sure that this can be adequately distinguished from the search for causes; nevertheless, his essay—nihilistic as parts of it are—helps to ground economic history in a philosophical context from which it has long been divorced.

Robert C. Allen | The Economic History Review | 2011

The British Industrial Revolution in Global Perspective is the best book on the country’s adoption of sustained economic growth at the turn of the nineteenth century, full stop. This paper concisely synthesizes most of the main ideas. Eighteenth-century British wages were exceptionally high by world standards, and especially relative to the prices of energy (coal) and capital (building materials). As Malthusian pressures winnowed South European living standards down to subsistence, the British and Dutch enjoyed three to five times that, boosted by success in trade and cloth production. High wages in London increased demand for fuel, leading to the extraction of coal as wood became too expensive to ship; thus an “infinite supply” of energy was made available at constant cost. This set of relative costs led to biased technological change through “induced invention”: since British labor was dear and capital cheap, techniques that economized on the former were worth developing through R&D (costly research). Consider the isocost diagram below. An invention yielding a technology using the proportions of capital and labor at point T will be profitable to adopt if the firm can reach a lower isocost curve (i.e. diminishing total costs) by doing so. Firm L, with a low capital-labor ratio, will find the new technology more expensive (T is on a higher line than L), but Firm H, the high-wage enterprise, can move to a lower line (from H to T). If the total savings are greater than the amortized cost of developing the technology per unit of output (D/qr), then this new process will enter production. This appears to be borne out by an accounting analysis of British and French mills: the Papperwick Mill in Nottingham would have earned a 40 percent annual return, while a French counterpart could only have done 9 percent (vs. 15 percent expected return on fixed capital). As a consequence, the late 1780s saw Britain with 150 modern mills, and France with just four.

Allen also discusses how the Industrial Revolution spread beyond high-wage Britain. Addressing a criticism frequently levied by Joel Mokyr, he notes that “local learning” led to the eventual and progressive saving of all inputs, not just labor; thus T would move down and to the left, and upon entering area II would become profitable for Firm L to adopt.4 Such a process would have enabled modern machinery to cross the channel, and eventually to spread into genuinely low-wage areas of East and South Asia. He concludes with some speculation about how the “inspiration” (required to launch the “perspiration” of deliberate R&D) for the major inventions came about. While he is sympathetic to scientific arguments, such as Mokyr’s, he argues that England was not distinguished in this realm relative to the Continent. Moreover, many of the great inventors—Wedgewood, Hargreaves, Arkwright—came from artisanal backgrounds. He suggests instead that the high-wage economy allowed the sons of tradesmen to purchase education and familiarize themselves with technical crafts to a sufficient degree to innovate upon pre-existing modes of production. There are valid critiques of the High-Wage Explanation: Humphries and Schnieder have attacked the empirical foundations (lowering wages), while a number of authors have expressed doubts that unit labor costs were particularly high in Britain (British workers were also more productive). Nevertheless, no more consistent and intellectually appealing framework exists for thinking about the period—and accurate or not, we are fortunate to have this model in our arsenal.

The deed was done by Kim Jae-Kyu, director of the Korean Central Intelligence Agency and Park’s close childhood friend.

That said, some learning-by-doing growth models—building on Romer’s famous 1986 paper—do stress that productivity growth may depend upon the size of skill-intensive manufacturing industry; see Matsuyama (1992) for one example.

Excuse the productivity joke.

Thus coal consumption fell from 44 lb/hp-hr to 2 lb/hp-hr from 1727 to 1860 thanks to inventions like the separate condenser and the high-pressure engine.